About Pinegap

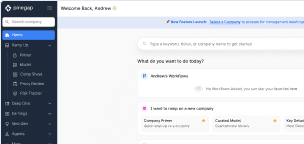

PineGap.AI is an AI-powered equity research platform built for institutional equity analysts and portfolio managers, helping them automate daily workflows across idea generation and validation, new companies ramp-up, and earnings analysis.

Leadership Team

Deepak Sharma

Co-Founder & CEO

An alumnus of IIT-BHU, Deepak leads PineGap.ai's vision, product strategy and overall execution.

Ankit Varmani

Co-Founder & CBO

Also an IIT-BHU graduate, Ankit brings 15+ years of Wall-Street-experience and leads business development, go-to-market and partnerships.

TEAM EXPERIENCE

Our Mission

Pinegap exists to elevate discretionary equity investing by becoming the essential intelligence layer for the modern buy-side. Our mission is to streamline complex research workflows, reduce noise, and accelerate informed decision-making — without compromising on data integrity.

The Challenge

Equity research has never been more demanding. Analysts must process enormous volumes of information, make decisions faster than ever, and maintain conviction in increasingly volatile markets — all while competing for an informational edge.

The Core Challenges:

- Information Overload: Filings, transcripts, broker notes, and news flow have exploded. Analysts are drowning in data but starved for time to extract insights.

- Slow, Manual Workflows: Ramp-ups, earnings prep, model updates, and monitoring are still highly manual, taking hours or days that should be spent on thinking, not searching.

- Hard to Maintain Conviction: With constant new information, it's difficult to track what strengthens or weakens a thesis — especially across multiple names.

- Fragmented Tooling: Analysts rely on a mix of PDFs, Excel, note-taking apps, and terminals. Insights live in silos, making knowledge sharing and continuity difficult.

- Reactive Research Model: Analysts rely on "pulling" information when something breaks — often finding issues too late, after the market has already moved.

- Human Bottlenecks: Teams are lean. Analysts juggle coverage, idea generation, and PM demands, leaving little time for deep thinking and differentiated research.

Why Pinegap?

Pinegap removes research friction and gives analysts real leverage — turning hours of manual work into minutes of insight.

Instant Insight, Not Information Overload:

Cuts through filings, transcripts, and disclosures to surface the facts that matter in seconds.

Automated Research, Not Manual Busywork:

AI Agents handle recurring workflows — earnings tracking, guidance changes, risks, insider moves — so analysts stay focused on thinking, not searching.

Rapid Ramp-Up, Not Reinventing the Wheel:

Company Primers and structured workflows get analysts up to speed on a new name in 10–15 minutes.

One Research Hub, Not Fragmented Tools

Models, notes, filings, agent alerts, and thesis updates live in one place, enabling team continuity and shared conviction.

Proactive Monitoring, Not Reactive Scrambling

Pinegap shifts research from "pull" to "push" — alerting analysts to key changes before the market reacts.

Start using Pinegap Now!

See how Pinegap can help your team with vast AI Integration.

Investors

We are proud to be supported by leading investors and some of the brightest minds in AI. Our backers include Inventus Capital Partners, Silicon Valley Quad, DeVC, and exceptional angel investors such as Mohit Aron, Founder of Cohesity and Nutanix; Mohan Kumar, Managing Partner at Avataar Ventures; Vetri Vellore, CEO and Founder of Rhythms and Ally.io; and Vivek Vipul, Managing Partner at FalconX Gateway. We’re thrilled to have their support as we build the future of AI-driven investment research.